Being busy doesn’t always mean you’re getting paid on time. In most trade businesses, cashflow delays don’t come from the work itself; they come from the “in-between” moments: an enquiry with missing details, a quote that’s unclear, a job that gets rescheduled twice, notes that never make it back to the office, or invoices that go out days later because you’re exhausted.

That’s why a jobs-to-cash workflow for tradies matters. It’s the end-to-end process that moves a job from first enquiry to approved work, completed job, invoice, payment received and recorded. The tighter the workflow, the fewer jobs get stuck, the fewer invoices get disputed, and the less time you spend chasing.

This article breaks it into 7 practical steps you can run the same way each time, not to add admin, but to reduce it. And throughout, we’ll stick to best practices for service invoicing and payments: clarity, consistency, and low friction.

Step 1: Capture the enquiry properly

The first few minutes of an enquiry can save you hours later.

When details are captured properly up front, you can quote faster, schedule with confidence, and avoid turning up to a job missing the one bit of info that makes the visit useless.

This is also where you quietly protect your calendar. Not every enquiry is a good fit. If you standardise what “good info” looks like: job type, address, urgency, access notes, you can quickly decide whether to proceed, ask one clarifying question, or politely pass.

A good enquiry capture also sets expectations. Customers feel looked after when they know what happens next: “We’ll review this, send a quote, then lock in a booking.” That little bit of certainty reduces follow-up messages and helps move the job forward.

Quick checklist

- Customer and site details captured in one place

- A clear job description on what’s wrong and what they want achieved

- Access notes captured early, including codes, parking, and strata/tenant rules

Step 2: Scope and quote clearly

Quoting is where most payment problems are either prevented or created. A quote isn’t just a price; it’s an agreement about what’s included and what isn’t. When customers don’t clearly understand the scope, they hesitate to approve… and later, they hesitate to pay.

The best quotes are written for normal people. You’re translating trade work into clear outcomes and clear line items. That clarity speeds up approvals and reduces the “can you explain this?” delay that often pauses payment later.

This is also the stage to handle uncertainty like a pro. If there are unknowns like hidden damage, access risks, or parts availability, call them out as assumptions and outline how changes will be handled. A simple variation process keeps the job moving without arguments: if scope changes, it gets priced and approved before extra work continues.

Quick checklist

- Inclusions/exclusions written clearly

- The variation process is documented with extra work approved before proceeding

- Terms like deposit/progress payments and due dates are stated upfront

Step 3: Schedule and dispatch with intent

Once a quote is approved, time becomes your enemy. Every day a job sits “approved but not booked” is a day your cashflow slips. Tight scheduling closes that gap quickly and stops jobs drifting into limbo.

Good scheduling isn’t just picking a time. It’s matching the right person, the right tools, and the right timing, while keeping your day realistic. When a schedule is too tight, jobs run late, notes get rushed, and invoicing gets pushed back. That’s how “one busy week” turns into “two weeks behind on invoices.”

Dispatch quality matters too. Whoever turns up needs enough context to work efficiently without ringing you for basics. If the job record is complete: access notes, photos, job history, the work gets done cleanly, and the invoice is easier to justify.

Quick checklist

- Booking confirmation sent with a time window and access details

- The right person is allocated based on skills/gear/parts considered

- Job notes and photos are visible to whoever is on-site

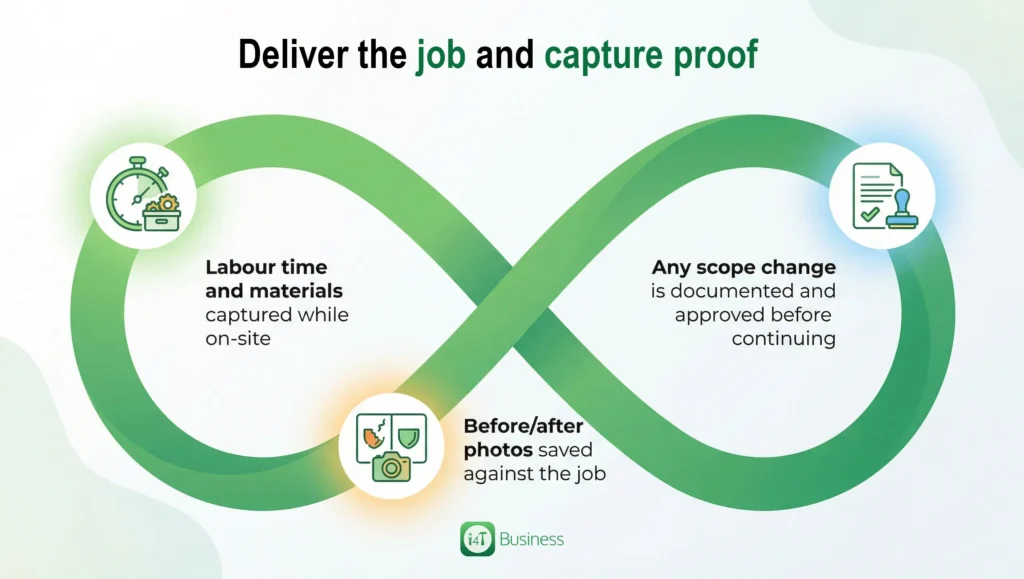

Step 4: Deliver the job and capture proof

This is the step that decides whether invoicing is easy or painful. If the job is completed but the details are missing, the invoice gets delayed, and delayed invoices get paid late.

Capturing proof doesn’t mean writing essays. It’s simply recording enough detail to explain the work clearly and support the invoice if someone questions it. For many trades, photos plus short notes are enough to reduce disputes dramatically.

This step also protects you during variations. When scope changes onsite, the best move is to keep the workflow clean: pause, price, approve, proceed. That avoids awkward surprises at invoicing time and keeps customer trust intact.

Finally, proof isn’t just about defence; it’s also about customer confidence. When a customer sees clear notes and evidence, they’re less likely to delay payment “until they’ve checked it.”

Quick checklist

- Labour time and materials captured while on-site

- Before/after photos saved against the job

- Any scope change is documented and approved before continuing

Step 5: Invoice immediately and correctly

If you want faster cash flow, this is the step with the biggest impact. Sending invoices late is one of the most common reasons tradies get paid late; not because customers are dodgy, but because urgency fades. The longer you wait, the easier it is for your invoice to get buried.

Same-day invoicing is powerful because everything is fresh: your memory is clear, your notes make sense, and the customer still feels the value of the work. It also reduces errors. When invoicing happens days later, details get guessed, line items get vague, and customers start asking questions, which delays payment.

This is where best practices for service invoicing and payments really come to life: clarity, consistency, and easy-to-follow terms. Your invoice should make it obvious what was done, what it cost, when it’s due, and how to pay, without a phone call.

Quick checklist

- Invoice sent as soon as the job is marked complete

- Line items written clearly

- Due date and payment instructions obvious and consistent

Step 6: Collect payment smoothly

Payment collection shouldn’t rely on how you’re feeling that day. If reminders only happen when you’re stressed, you’ll be inconsistent, and customers will treat your invoices as optional.

A smooth collection process starts by reducing friction. If paying is easy and instructions are clear, you remove the most common “excuses”: I couldn’t find the details, I’ll do it later, I wasn’t sure what this line was. Then you add a predictable reminder rhythm that’s polite but firm.

It also helps to separate “late” from “stuck.” Late payments need reminders. Stuck payments need a blocker removed, like wrong email, missing info, and internal approval delays. When you diagnose the reason, you collect faster with less chasing.

Quick checklist

- Clear payment options/instructions included every time

- Friendly remindersare sent around due date and after overdue

- Disputes handled quickly using job notes/photos

Step 7: Reconcile and improve

Payment isn’t finished until it’s recorded properly. Reconciliation is simply matching payments received to invoices issued, so you know exactly what’s outstanding and what’s already been paid.

When reconciliation is irregular, your numbers get muddy. You might chase people who already paid, miss the ones who didn’t, and lose confidence in your cash position. That uncertainty makes hiring, ordering stock, and planning growth feel risky.

You don’t need complex reporting. Track just a few basics so you can improve your workflow without guesswork: time from job completion to invoice, time from invoice to paid, and overdue rate. Then tighten the biggest bottleneck first. Small improvements here compound quickly over dozens of jobs.

Quick checklist

- Payments are matched to invoices regularly

- Simple metrics tracked monthly – time-to-invoice, time-to-paid, overdue %

- Fix the biggest bottleneck first, then reassess

Turn enquiry-to-paid into a routine you can trust

A reliable jobs-to-cash workflow for tradies isn’t about doing more admin, it’s about doing less rework. Capture clean enquiries, quote with a clear scope, schedule with intent, document the job properly, invoice immediately, collect payments without emotion, and reconcile regularly.

When those handoffs are solid, cash flow becomes steadier and chasing becomes the exception, not the norm.

If you want to run the full enquiry-to-paid workflow in one place, enquiries, quoting, scheduling, job tracking, invoicing, and payment status, i4T Business is built to help tradies cut double-handling and move jobs through to payment faster.

FAQs

It’s the process from enquiry through to invoice and payment received and recorded.

Late invoicing, unclear scope, and inconsistent follow-ups.

As soon as the job is completed, same day if possible.

Quote clearly, approve variations before extra work, and capture photos/notes.

It keeps enquiry, scheduling, job notes, invoicing, and payment tracking connected.

Hot off the press!

![What Should My Work Order Include? [Checklist + Download]](https://i4tbusiness.com/au/wp-content/uploads/2026/01/b6-300x157.webp)