Let’s face it, understanding the concept of profit margins may seem too technical and boring. However, you need to nail it down to the point to make sure that your business will succeed in the market.

So, what is the profit margin, and what does it do? Think of it as a quick way to check how much money your business keeps after paying for all its expenses. It’s like the heartbeat of your business, showing you how healthy things are financially.

There are a few types of profit margins, like gross, operating, and net margins. Each one gives you a clearer picture of where your money’s going and how much you’re earning. The best part? Tools like Job Management Software can make tracking all this super easy, so you can focus on what matters, growing your business.

Ready to break it down? Let’s get started!

Why profit margins matter for the success of your business

Did you know that profit margins are more than just numbers? They show the financial health of your business, and it is a key driver of growth and sustainability. Here are some of the reasons why it is essential to understand them as a business owner.

- Keep track of your business health: Profit margins show how much money you’re keeping after covering costs. A good margin means you’re running things smoothly, while a low margin is like a red flag telling you to review your expenses or pricing.

- Set the right prices: Margins help you price your services properly. You don’t want to charge too low and barely make a profit or too high and scare off customers. It helps you to find the right balance.

- Spot cost issues early: If your margins are dropping, it could mean your costs, like materials, tools, or fuel, are eating into your earnings. Knowing this lets you take action fast, like negotiating better deals or cutting unnecessary expenses.

- Grow your business with confidence: The higher your profit margin, the more cash you have to invest in growing your business. Strong margins give you the flexibility to expand, whether it’s buying new equipment, hiring staff, or marketing your services.

- Prepare for tough times: Every business has ups and downs. Good profit margins act as a safety net, helping you get through slow seasons or unexpected expenses without breaking a sweat.

- Attract partners or investors: Thinking of teaming up or bringing in an investor? Your profit margins are one of the first things they’ll look at to see if your business is worth their time and money.

- Make smarter decisions: When you know your margins, you can make better choices, like deciding whether to take on a big project, adjust your rates, or invest in new tools.

What are the factors that affect profit margins?

Now you know why it is important to understand your profit margins. However, your profit margins are influenced by various factors. You need to identify them and adopt better strategies to control them and run your field service business smoothly. Let’s break them down one by one so that you can understand how they matter to your business.

- Cost of goods sold (COGS): This includes everything you spend on materials, tools, and labour needed to complete a job. If these costs go up, your profit margins will take a hit.

- Pricing: The prices you charge from the clients will directly impact your profits. If your prices are too low, you might struggle to cover your expenses. If they’re too high, it can turn customers away.

- Overhead costs: These are the fixed expenses like rent, insurance, and administration costs that you should incur to run your business. Even if you’re doing a good volume of work, high overheads can eat into your profits.

- Sales volume: The number of jobs you complete affects your margins. A steady stream of work can help spread fixed costs across more income and boost your profitability.

- Efficiency: How well you manage time and resources also plays a big role. Inefficiencies, like wasted time or materials, can drag down your margins quickly.

- Market conditions: Changes in the market, such as increased competition, shifts in demand, or rising material costs, can influence your profit margins.

- Customer payments: Delayed payments or unpaid invoices can directly hurt your cash flow and shrink your profits.

What are the common mistakes to avoid when managing profit margins

Managing profit margins is pretty straightforward, but some mistakes can easily chip away at your profits if you’re not careful. Let’s go through some common missteps that you might make so you can steer clear and keep your business on track.

- Setting prices too low: Trying to win customers with low prices might seem like a good idea, but it often leaves you barely covering costs. Your prices should reflect the value of your work and still leave you with a profit.

- Not keeping up with rising costs: Material prices, fuel, and wages don’t stay the same forever. If you’re not adjusting your prices to account for these increases, your margins will shrink before you even notice.

- Forgetting to track expenses: Little expenses like extra trips for supplies or overlooked fuel costs can add up fast. If you’re not watching where your money goes, it’s easy to lose control of your spending.

- Wasting time on the job: You will only be able to complete more jobs if your scheduling function is efficient. Time is money, and wasting time will eat into your profits.

- Delaying invoices and payments: Late invoicing or slow follow-ups on overdue payments can mess up your cash flow. Without a steady income, it can be difficult to cover your bills.

- Ignoring seasonal patterns: Demand can go up and down depending on the season. Not preparing for these changes can leave you scrambling during slow times or overwhelmed during busy periods.

- Skipping on technology: Trying to manage everything manually can lead to human errors and a lot of inefficiencies. Tools like Job Management Software can help you automate tasks, save time, and avoid mistakes.

- Not training your team: If your staff doesn’t know how to work efficiently, it costs you time and money. Proper training ensures that your team will do the job correctly the first time.

What are the strategies you can use to maximise profit margins

Maximising profit margins isn’t just about cutting costs. You should make smart decisions that improve efficiency, increase revenue, and keep your customers happy. Here are some practical strategies every field service business owner should consider when maximising their profit margins:

- Review and adjust your pricing regularly: Ensure your pricing reflects the value of your services and covers the rising costs. Don’t undervalue your work. Your skills and time matter.

- Negotiate better deals with suppliers: Building strong relationships with suppliers can help you secure better rates on materials and tools, helping to keep the costs under control.

- Improve job scheduling and routing: Efficient scheduling will reduce time and fuel wastages. Tools like Job Management Software can help you optimise routes and ensure your team is working efficiently.

- Reduce material waste: Plan your materials carefully to avoid over-ordering or underusing supplies. Tracking material usage can help you to save money and increase your profit margins.

- Focus on repeat customers: Retaining customers will cost less than finding new ones. Therefore, provide an excellent service and maintain good communication to encourage repeat business.

- Streamline administrative processes: Automate invoicing, payments, and scheduling to save time and minimise errors. When you automate these functions, you can focus more on your core work.

- Track and analyse your costs: Regularly review where your money is going. Understanding which jobs or expenses are eating into your profits helps you make better financial decisions.

- Train your team for efficiency: A well-trained team will do their jobs faster without compromising quality. This improves customer satisfaction and reduces labour costs.

- Adjust for seasonal demand: During busy seasons, make sure that you’re charging appropriately for higher demand. You can also hire temporary staff during the busy season to handle the workload. In slower times, cut off on unnecessary expenditures and give special offers to promote your services.

- Leverage marketing to attract high-value customers: Target customers who value quality and are willing to pay for it. Use online reviews, social media, and referral programs to attract more of these clients.

- Invest in the right tools and technology: Using software and modern tools like job management software will not only save time but also improve accuracy in estimating, scheduling, and invoicing.

How to manually calculate profit margins

As we said earlier, profit margins are essential for understanding how your field service business is performing. Whether you’re a plumber, electrician, or HVAC technician, knowing how to calculate your margins will help you stay on top of your finances. Let’s dive into the details with figures and examples and find out how to manually calculate different types of profit margins.

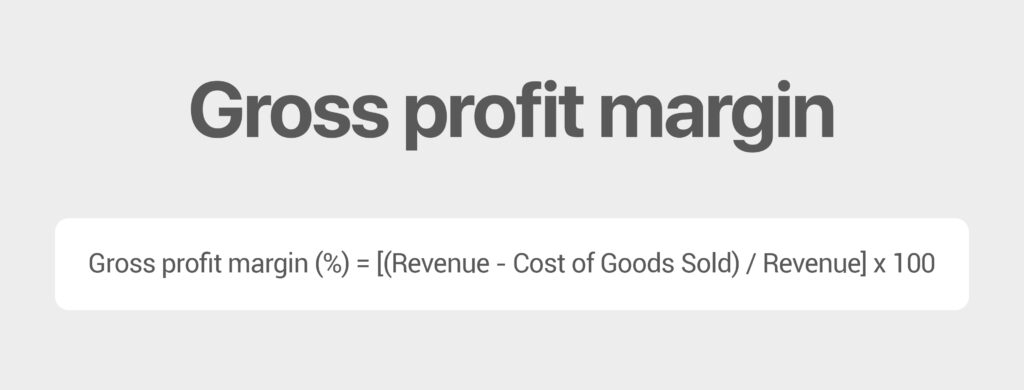

Gross profit margin

Your gross profit margin measures how much money is left after covering direct costs, such as materials and labour, which are common in field service businesses. You can use the following formula to calculate the gross profit margin:

Gross profit margin (%) = [(Revenue – Cost of Goods Sold) / Revenue] x 100

Suppose your monthly revenue is AUD 15,000, and your costs for materials and direct labour total AUD 6,000.

Gross profit margin = [(15,000 – 6,000) / 15,000] x 100 = 60%

This means 60% of your revenue is left after covering direct costs.

It is ideal to keep your gross profit margin between 50% to 70%. It shows how well you’re managing your core costs and services.

Operating profit margin

The operating profit margin factors in operating expenses like tools, fuel, software subscriptions, and office staff wages. You can use the following formula to calculate the operating profit margin.

Operating profit margin (%) = [(Gross Profit – Operating Expenses) / Revenue] x 100

Suppose your revenue is AUD 15,000, your gross profit is AUD 9,000, and your operating expenses (fuel, wages, insurance, and software) are AUD 3,000.

Operating profit margin = [(9,000 – 3,000) / 15,000] x 100 = 40%

Therefore, your operating profit margin would be 40%. It reflects how efficiently you are managing your operating expenses and running the business.

It is ideal for trade businesses to maintain an operating profit margin ranging from 30% – 50%.

Tools like Job Management Software can help reduce operating expenses by optimising scheduling and fuel costs, helping you to maintain a healthy margin.

Net profit margin

Your net profit margin is the final measure of profitability, which takes into account all your expenses, including taxes and loan repayments. Your total expenses must include both operating expenses and the cost of goods sold. You can use the following formula to manually calculate the net profit margin.

Net profit margin (%) = [(Revenue – Total Expenses) / Revenue] x 100

Suppose you have a revenue of AUD 15,000 and total expenses of AUD 12,000 (including taxes and interest).

Net profit margin = [(15,000 – 12,000) / 15,000] x 100 = 20%

Then, your net profit margin would be 20%. It is ideal to maintain a net profit margin between 20-30%. This margin shows whether your pricing and cost management strategies are sustainable and help you to stay competitive in the industry.

Why you should use profit margin calculators and job management software

Managing a field service business can get overwhelming, especially when you have to manage multiple tasks like pricing jobs, scheduling, and tracking expenses. That’s where modern tools like plumbing business management software, profit margin calculators, and job management software come in handy. Here’s why they’re worth it:

- Track profits easily: Profit margin calculators show you exactly how much money you’re making from each job. You don’t have to do confusing maths, just quick and clear numbers to help you see what’s working.

- Save time on administration work: Job management software handles invoicing, scheduling, and payments for you. It frees up your time so you can focus on doing more jobs.

- Better job scheduling: Stop wasting time on the road or dealing with double bookings, which is costly for your business. Job management tools help you plan smarter routes and assign tasks efficiently.

- Keep payments on track: With automated invoicing and reminders, you can avoid chasing overdue payments. It helps keep your cash flow steady and your business running smoothly.

- Understand your business better: These tools give you insights into your expenses, revenue, and profits. Therefore, you can see which jobs are making money and where you need to improve.

- Cut costs and boost profits: By tracking materials, labour, and other costs, you can spot where you’re overspending and make adjustments to increase your profit margins.

- Stay ahead of competitors: With these tools, you can work smarter, not harder. They help you run a more efficient business and stand out in a competitive market.

Now, you can take the guesswork out of managing your profit margins for free with the i4T Business Profit Margin Calculator. This easy-to-use tool helps you instantly calculate your margins, giving you clear insights into your business performance.

Conclusion

Keeping track of your profit margins is one of the most important steps to running a successful field service business.

Understanding your profit margin is not just about numbers, it’s about understanding how your business is performing and knowing where you can improve.

By regularly reviewing your costs, setting the right prices, and working efficiently, you can make sure your margins stay healthy. Little changes, like cutting unnecessary expenses or streamlining your scheduling, can make a big difference over time.

The best part? You don’t have to do it all manually. Tools like i4T Business make it easy to manage everything in one place. From tracking profit margins to scheduling jobs and automating invoices, it’s built to help field service businesses save time and boost profits.

Take control of your business by tracking and adjusting your profit margins regularly. With the right focus and the right tools, you can not only run your business smoothly but also set it up for long-term growth.

Are you ready to make it happen? Check out our free trial and see how i4T Business can simplify your day-to-day operations while keeping your profits on track!

FAQs

It streamlines operations, reduces waste, and improves efficiency by automating scheduling, invoicing, and cost tracking.

Fixed costs, like rent, reduce margins if sales are low. Spreading these costs across a higher job volume can help to improve profitability.

It optimises scheduling, tracks resources, and minimises wasted time and fuel, leading to lower operational expenses.

Different industries have unique cost structures, competition, and pricing, leading to varying profit margins.

Yes, many job management software solutions offer real-time insights into job costs, revenue, and profit margins, keeping you updated.

Hot off the press!

Field Service Management sector operates, the i4TGlobal Team loves to share industry insights to help streamline your business processes and generate new leads. We are driven by innovation and are passionate about delivering solutions that are transparent, compliant, efficient and safe for all stakeholders and across all touch points.