Most tradies don’t go into business because they love spreadsheets and cash flow forecasts. You start because you’re good with the tools, you care about quality work, and you want the freedom to run jobs your way. But before long, you realise something: being busy doesn’t always mean there’s money in the bank.

In field service and trades, money often goes out before it comes in. You pay for materials, wages, fuel and time well before you issue a final invoice. If that invoice is delayed, disputed or ignored, you’re suddenly bearing all the risk.

That’s where smart cashflow for field service comes in. It’s not just about chasing overdue invoices. It’s about designing payment structures that support your business from day one. Three tools make the biggest difference:

- Deposits

- Milestone payments

- Progress claims

Used properly, these turn your jobs into a steady flow of income instead of a big lump sum at the end. In this article, we’ll walk through how each one works, when to use it, and how job management software like i4T Business can make the whole process simple and repeatable.

Deposits: Starting Every Job on Solid Ground

Deposits are the first and simplest way to protect your cash flow. Instead of carrying all the risk upfront, you share it with the customer in a fair and transparent way.

Why Deposits Matter for Tradies

A deposit is an upfront payment made by the customer to confirm a job. It shows they’re serious and gives you enough money to cover those early costs that always pop up before you even arrive on site.

Those costs often include:

- Materials and special-order parts

- Time spent quoting, planning and scheduling

- Blocking out a day or more for your team

- Fuel and travel

Without a deposit, you’re effectively acting as the bank for your customer. If they cancel, delay or vanish, you’re left out of pocket. With a deposit, you’re protected from at least some of that risk and can start the job with confidence instead of worry.

When You Should Ask for a Deposit

While you might not bother for a tiny fix, many jobs absolutely should start with a deposit. As a general guide, deposits make sense when:

- The job is worth more than a few hundred dollars

- You need to order gear or custom materials

- You’re dealing with a new or unknown customer

- The job will take more than one visit

- The work is urgent, after-hours or weekend only

Many field service businesses work on something like 20–50% upfront, depending on the size and type of work. The aim isn’t to bill everything at the start; it’s to cover enough so you aren’t carrying all the early costs on your own.

How to Talk About Deposits Without Feeling Awkward

For a lot of tradies, the hardest part of deposits is the conversation. The trick is to build deposits into your process so they feel normal, not negotiable.

You can make this easier by:

- Including the deposit clearly on the quote

- Explaining that it covers materials and secures the booking

- Making it easy to pay via card, online link or bank transfer

- Setting the expectation that work is scheduled once the deposit is received

A simple line on the quote, like “A 30% deposit is required to secure your booking and cover materials,” goes a long way. When customers see this upfront rather than being told later, it feels professional and organised rather than pushy.

Automating Deposits with Field Service Software

Deposits really shine when they’re built into your job management system. A good software can:

- Automatically add deposit amounts to certain job types

- Turn an approved quote into a deposit invoice in one click

- Track which jobs are “deposit paid” versus “deposit pending”

- Stop jobs from being scheduled before the deposit is received

That means less awkward chasing, fewer manual reminders, and a more reliable starting point for every job.

Milestone Payments: Keeping Cash Flow Steady During the Job

Deposits help you at the start. Milestone payments help you stay balanced while the work is happening.

What Are Milestone Payments?

Milestone payments break a job into clear stages, with a portion of the total billed at each stage. Instead of waiting for one big amount at the end, you collect smaller amounts as the job moves along.

This suits jobs that:

- Run for several days or weeks

- Involve multiple phases of work

- Require different crews or trades

- Use a lot of materials at different stages

Milestones line up your income with your effort. When a stage is done, you get paid for that part. You’re not carrying the entire cost of the job on your shoulders until the finish line.

Examples of Milestones in Field Service

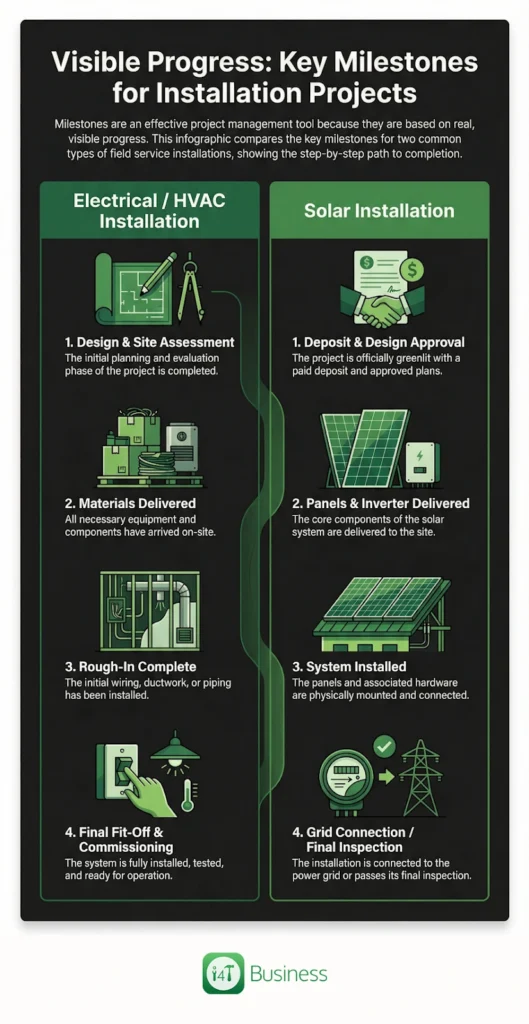

Milestones work well because they’re based on real, visible progress. For example:

- For an electrical or HVAC install:

- Design and site assessment completed

- Materials delivered to the site

- Rough-in complete

- Final fit-off and commissioning done

- For a solar installation:

- Deposit paid and design approved

- Panels and inverter delivered

- System installed

- Grid connection or final inspection completed

Customers understand these stages, and you can point to them easily on-site. That clarity is what makes milestone billing feel fair to both sides.

How Milestones Help Cash Flow and Reduce Risk

Milestone payments smooth your cash flow across the life of a job. You don’t have a big gap where you’re working hard, buying gear and paying wages with nothing coming in.

They also reduce risk. If a customer changes their mind halfway through, or there are delays or scope changes, you’ve already been paid for the work up to that point. You’re not left with a mountain of unpaid labour and materials.

For customers, milestones are reassuring because:

- They can see the progress they’re paying for

- They’re not handing over the entire amount upfront

- They know what’s coming next on the schedule and on the invoice

It builds trust and keeps things transparent.

Building Milestone Payments into Your Workflow

To make milestones practical instead of painful, it’s worth setting up a simple, repeatable structure.

A typical workflow might look like this:

- You create a quote that clearly shows the milestones and amounts

- The customer approves the quote, knowing when each payment is due

- Your team works through the stages on-site

- When a stage is complete, the tech updates the job status

- The office (or system) sends the milestone invoice straight away

With FSM software, you can link job statuses to billing triggers. That means when a tech marks “Rough-in complete” in the app, the system knows it’s time for the next invoice. You don’t forget to bill, and you don’t wait weeks to charge for work done.

Progress Claims: Staying Cash-Positive on Long or Complex Projects

For bigger, ongoing or commercial jobs, progress claims take over where simple milestones might not be enough.

What Are Progress Claims?

Progress claims are invoices based on the percentage of work completed to date. Instead of fixed stages, you look at the job as a whole and bill regularly for the portion that’s been done.

This approach is common in:

- Construction projects

- Government and commercial contracts

- Large-scale or multi-site installations

- Long jobs with lots of moving parts

Progress claims are essential when your costs are spread over a long period. They make sure you’re not waiting months to be paid for work you’ve already completed.

When Progress Claims Make Sense

Progress claims are especially helpful when:

- Labour runs for weeks or months

- Materials are purchased in stages

- Variations and changes are likely

- You’re reporting to a head contractor or project manager

Instead of a lumpy income, progress claims give you a regular flow of cash. That keeps wages, supplier bills and overheads covered while the job is still running.

Why Documentation Is Key

Progress claims live or die on how well they’re backed up. Customers and head contractors want to see that your claim matches what’s actually happened on site.

The kind of information that helps includes:

- Timesheets linked to the job

- Site notes and checklists

- Photos showing what’s been done

- A record of materials used

- Details of any variations or extras

If you’ve been tracking all this in your field service system, putting together a progress claim becomes much easier. You’re not guessing or digging through old messages, it’s all there in one place.

Using FSM Data to Create Strong Progress Claims

A good FSM platform becomes the “source of truth” for your jobs. As your techs work, they log:

- Time spent on site

- Photos and notes

- Materials consumed

- Job stage updates

When it’s time to issue a progress claim, you can pull directly from this data. That means:

- Your claims are accurate

- Approvals are faster because everything is documented

- Disputes are reduced because you can show exactly what’s been done

Over a long project, that accuracy protects your cash flow and your relationship with the client.

Turning These Into a Simple Cash Flow System

Deposits, milestones and progress claims aren’t three unrelated tricks. Together, they form a simple system you can use across all your work.

You might use them like this:

- For small, quick jobs, you can skip the deposit for existing, reliable customers, and ask for a small deposit for new clients or material-heavy jobs

- For medium-sized residential work, you can ask for a deposit to start, one or two milestone payments during the job, and a final payment at completion.

- For longer or commercial projects, ask for a deposit or mobilisation fee, and regular progress claims based on percentage completed

The key is to write your own rules so you’re not reinventing it every time.

Once these rules are inside your FSM system, your team doesn’t have to remember them — the software does the heavy lifting.

i4T Business helps you build those rules into your quoting, scheduling, job tracking and invoicing. Instead of chasing payments and juggling spreadsheets, you’ve got a clear process that keeps money flowing in step with the work you do.

Structure Your Cash Flow So You’re Not Always Chasing It

At the end of the day, cash flow is what keeps your field service business alive. It pays your team, supports your growth and lets you sleep at night instead of stressing about overdue invoices.

The smartest tradies don’t leave cash flow to chance. They use deposits, milestone payments and progress claims to protect new jobs, stay balanced and cash-positive.

All of this becomes much easier with the right job management platform. i4T Business is designed specifically for tradies and service businesses, helping you build these payment structures into your day-to-day workflows.

If you want to improve cashflow for field service, reduce stress and get paid in line with the work you do, i4T Business is a great place to start. You can streamline quoting, automate invoicing, track job progress and turn messy payment habits into a simple, reliable system.

FAQs

You don’t need to on every single job, but for larger, material-heavy or new-customer jobs, deposits make a huge difference. They protect you from cancellations and stop you from funding everything upfront out of your own pocket.

Most jobs work well with two or three milestones. Too many can confuse everyone; too few can leave you financially exposed. Aim for milestones that match natural stages of work the customer can clearly see.

Progress claims are ideal when jobs are long, complex or under a commercial or construction-style contract. If work stretches over many weeks or months and you’re regularly updating progress, progress claims are usually the better fit.

That’s usually a sign the job could become risky. Calmly explain that deposits and staged payments protect both of you and are standard practice. If they still refuse, you may decide the risk isn’t worth it.

i4T Business helps you set up deposit rules, milestone billing and progress claims directly inside your job workflows. It connects quoting, scheduling, job updates, photos, timesheets and invoicing so you’re not chasing information or forgetting to bill. That means better cash flow, less admin, and fewer money headaches.

Hot off the press!