You’ve wrapped up another solid job. The tools are packed, the customer’s happy, and you send off the invoice feeling good about ticking another one off the list.

Then the waiting game begins.

Days turn into weeks. You start checking your bank account more than usual, wondering if the payment’s just delayed… or if it’s time for that awkward follow-up message. Sound familiar?

For many tradies and small business owners across Australia, getting paid late isn’t about poor work, it’s about unclear invoice terms and conditions. When your invoices don’t spell out the how, when, and what-ifs of payment, things can quickly turn messy.

Clients get confused, deadlines slip, and before you know it, your cash flow’s as unpredictable as Melbourne weather.

That’s why having clear, fair, and easy-to-understand invoice terms isn’t just about protecting your business; it’s about keeping your relationships professional, your payments prompt, and your stress levels low. It shows clients that you run your business seriously and sets expectations from day one.

In this guide, we’ll walk through 10 simple but powerful rules every Aussie business owner should follow to make their invoices rock-solid, helping you get paid on time, every time, without chasing or awkward reminders.

Rule #1: Clearly Define the Scope of Work

What Is the Scope of Work on an Invoice?

The scope of work in your invoice terms and conditions defines exactly what job or service you’re being paid for; no more, no less. It’s the clearest way to avoid confusion and make sure everyone’s on the same page before payment is due.

Why It Matters:

Most disputes don’t start because clients refuse to pay; they happen because expectations weren’t clear. Maybe a client thought a repair included a replacement, or assumed extra work was part of the deal. When the scope isn’t nailed down, your “quick job” can quickly turn into a headache.

How to Write It Clearly:

Your invoice should clearly outline:

- What’s included: e.g. “Supply and installation of new deadbolt lock on front door.”

- What’s not included: e.g. “Back door lock replacement excluded.”

- Any conditions: e.g. “Quote valid for 14 days. Work subject to site inspection.”

Rule #2: Set Clear Payment Terms and Due Dates

What Are Payment Terms?

Payment terms specify when and how your client needs to pay you. This is one of the most important parts of your invoice terms and conditions; it directly affects your cash flow.

Why It Matters:

When your invoices say “Payment due soon” or “ASAP,” clients read that as “Whenever.” Clear due dates keep your business running smoothly and make payments predictable. It’s about respect for your time and professionalism.

How to Write Effective Payment Terms:

- Set a clear deadline: Use simple wording like “Payment due within 14 days of invoice date.”

- Offer flexible options: Mention accepted payment methods: EFT, card, BPAY, or mobile pay.

- Include payment details: Bank account, ABN, invoice number, and reference fields.

- Add a polite reminder: “To keep projects running smoothly, please make payment within 14 days. Late payments may attract a small fee in line with our standard invoice terms and conditions.

Rule #3: Include Late Payment Penalties

What Are Late Payment Penalties?

Late payment penalties are small fees or interest charges you apply when a client doesn’t pay their invoice by the due date. They’re a key part of your invoice terms and conditions because they encourage clients to stick to agreed timelines, and help you protect your cash flow.

Why You Should Include Them:

In business, time is money, literally.

When payments are delayed, it’s not just the money you lose, it’s the flow of your entire operation. You’re stuck covering materials, wages, or suppliers while waiting for someone else’s delay.

Having a clearly written late payment policy sets expectations upfront.

How to Word It Professionally:

Here’s an example clause you can include in your invoice terms and conditions:

“Invoices are due within 14 days of issue. A late fee of 5% per month may be charged on any overdue amount.”

Keep it polite, simple, and consistent across all your invoices. Make sure the fee is reasonable; the goal is to encourage prompt payment, not punish your customers.

Rule #4: Add Deposit and Progress Payment Clauses

What Are Deposit and Progress Payment Clauses?

Deposit and progress payment clauses are parts of your invoice terms and conditions that outline when and how clients pay you before the full job is complete. They protect your business cash flow, especially for larger or ongoing projects.

A deposit secures the booking and covers upfront costs like materials or travel, while progress payments ensure you’re paid fairly as each stage of the job is finished.

Why They Matter:

Ever started a big job only to realise you’re footing the bill until the end? That’s a fast track to cash-flow chaos. Deposits and progress payments protect you from delays, cancellations, and non-payment once the work is done.

These clauses make clients accountable and help you keep the job running without dipping into your own pocket. They also show that you operate like a pro — not just a “pay-me-later” tradie.

How to Include Them in Your Invoice Terms and Conditions:

Here’s a simple structure you can use:

- Deposit amount: “A 30% deposit is required to confirm the booking.”

- Progress payment stages: “40% due upon completion of installation, 30% due upon final sign-off.”

- Payment schedule: Outline exact dates or milestones tied to project stages.

Keep it clear, simple, and easy to follow; no client likes surprises when it comes to payments.

Rule #5: Specify Retention Terms (If Applicable)

What Are Retention Terms?

Retention terms are conditions in your invoice terms and conditions that explain how a portion of your payment is temporarily held back by the client, usually until a project is fully completed and all work meets agreed standards.

This is common in larger projects like construction, electrical, plumbing, or fit-outs, where a percentage (often 5–10%) is held as a guarantee that the job will be completed properly.

Why They Matter:

Many tradies misunderstand retention and assume it’s money the business keeps. In reality, the client holds the funds until the project’s end to make sure everything’s done to spec.

Including clear retention terms protects both sides:

- For the client: It ensures accountability and quality workmanship.

- For you: It guarantees that once you’ve met the agreed conditions, the money gets released; no unnecessary delays or disputes.

Without clear retention clauses, clients may delay releasing funds or hold more than agreed. That’s why it’s crucial to define the rules upfront in your invoice terms and conditions.

How to Write Retention Terms Clearly:

Use straightforward, professional language like this:

“A retention amount of 5% will be withheld until 30 days after project completion, subject to final inspection and sign-off.”

Rule #6: State Warranty or Guarantee Conditions

What Are Warranty or Guarantee Conditions?

Warranty or guarantee conditions in your invoice terms and conditions outline what kind of after-service support you provide, and for how long. They let your clients know you stand by your work, while protecting you from unfair claims down the track.

Why They Matter:

Warranties aren’t just about compliance. They’re about trust. Clients feel more confident working with tradies who clearly state what’s covered (and what’s not). At the same time, you protect yourself from unrealistic expectations, like being blamed for wear and tear months after the job’s done.

A well-written warranty clause shows professionalism and prevents those awkward “Can you come back and fix it for free?” conversations.

How to Include Warranty Clauses in Your Invoice Terms and Conditions:

Keep it simple, specific, and realistic.

“All workmanship is guaranteed for 12 months from the completion date. This warranty does not cover damage caused by misuse, lack of maintenance, or work performed by others.”

You can also mention any manufacturer warranties that apply to materials or parts you’ve supplied.

Rule #7: Include a Liability Disclaimer

What Are Cancellation or Change-of-Work Policies?

These are clauses in your invoice terms and conditions that explain what happens if a client cancels a job, delays it, or decides to change the scope after work has started.

They set out who pays for what when plans change, protecting your time, your materials, and your sanity.

Why They’re Important:

Jobs don’t always go as planned. Clients might cancel at the last minute, push the job back a week, or decide halfway through that they want something completely different. Without a clear cancellation or change-of-work policy, you could end up out of pocket for time and materials you’ve already invested.

Having these policies written upfront helps you:

- Avoid awkward money conversations later

- Keep projects running smoothly

- Show clients you value fairness and transparency

How to Write Them Clearly in Your Invoice Terms and Conditions:

Keep your tone polite but firm. You can say something like:

“Cancellations made within 24 hours of the scheduled job time may incur a 20% fee to cover preparation and travel costs. Any major changes to the scope of work will be discussed and priced before proceeding.”

This sets boundaries that keep things fair for both sides.

Rule #8: Outline Cancellation or Change-of-Work Policies

What Is a Liability Disclaimer?

A liability disclaimer in your invoice terms and conditions protects your business from being held responsible for issues that are outside your control, like damage caused by pre-existing faults, poor materials supplied by the client, or unexpected site conditions.

Why It’s Important:

Even the best tradies can’t control every outcome. If you don’t have a liability disclaimer, you could end up paying for problems you didn’t cause, and that’s money straight out of your pocket.

A clear disclaimer helps you:

- Set realistic expectations with clients

- Avoid unnecessary arguments or claims

- Show professionalism while keeping things fair for everyone

How to Write a Liability Disclaimer in Your Invoice Terms and Conditions:

Keep it short, clear, and balanced; not too formal or intimidating. For example:

“The contractor is not liable for any indirect, incidental, or consequential damages that may arise from the performance of services. All care is taken to ensure work quality, but no responsibility is accepted for pre-existing damage or issues outside our control.”

This language protects you while showing that you still care about quality and client satisfaction.

Rule #9: Include Confidentiality and Privacy Terms

What Are Confidentiality and Privacy Terms?

Confidentiality and privacy terms in your invoice terms and conditions explain how you handle your client’s personal information, things like names, addresses, phone numbers, and payment details.

They show that you take data security seriously and that you’re following Australian privacy laws, which helps build trust and credibility with your clients.

Why They’re Important:

When you’re working in clients’ homes or businesses, you often come across private information, alarm codes, security systems, gate access details, or customer contact data. If clients trust you with this information, you need to assure them it’ll be handled safely.

Including privacy and confidentiality terms helps you:

- Comply with Australian Privacy Principles (APPs)

- Protect your reputation if there’s ever a data-related issue

- Show clients you’re professional and trustworthy

How to Add Them to Your Invoice Terms and Conditions:

Keep the language short, clear, and confident. For example:

“All client information collected will be used solely for the purpose of completing the requested work and processing payment. Personal data will not be shared with any third parties, except as required by law.”

You can also include a link to your business’s full privacy policy if you have one on your website.

Rule #10: Define Governing Law (Legal Protection)

What Is a Governing Law Clause?

A governing law clause in your invoice terms and conditions specifies which state or territory’s laws apply if there’s ever a legal dispute between you and your client.

In plain English, it sets the “rules of the game.” If things ever go south (hopefully never), this clause tells everyone which court or legal system would handle it.

Why It’s Important:

If you work across different states or regions, laws can vary. Without a governing law clause, disputes can get messy fast, especially if a client is based in a different location.

Adding this clause helps you:

- Avoid confusion about where disputes are handled

- Keep legal costs predictable

- Show that you take your business seriously and operate professionally

Even if you never end up needing it (and let’s hope you don’t!), having it there adds a layer of protection and credibility to your invoices.

How to Include It in Your Invoice Terms and Conditions:

It doesn’t need to sound like a lawyer wrote it. Keep it short and clear:

“This agreement is governed by the laws of New South Wales, Australia. Any disputes arising under this invoice shall be subject to the exclusive jurisdiction of the courts in New South Wales.”

Bonus Tip: Make Your Invoice Easy to Read and Professional

Even the best invoice terms and conditions won’t do their job if your invoice looks confusing, messy, or incomplete. Presentation matters; a clear, professional layout shows clients you mean business and makes it easier for them to pay on time.

Think of your invoice as a reflection of your brand. A well-structured, easy-to-read invoice builds confidence and reduces back-and-forth questions like “Where do I pay?” or “What’s this charge for?”

What to Include for a Clean, Professional Invoice:

Here’s a quick checklist:

- Your business details: Logo, business name, ABN, and contact info

- Client details: Name, address, and job reference

- Clear itemised list: Break down services and materials separately

- Total amount due: Highlight GST if applicable

- Payment options: Make it as simple as possible (EFT, card, etc.)

- Invoice terms and conditions: Include them in a clearly visible section or link

Simple formatting helps clients pay faster because everything they need is right in front of them.

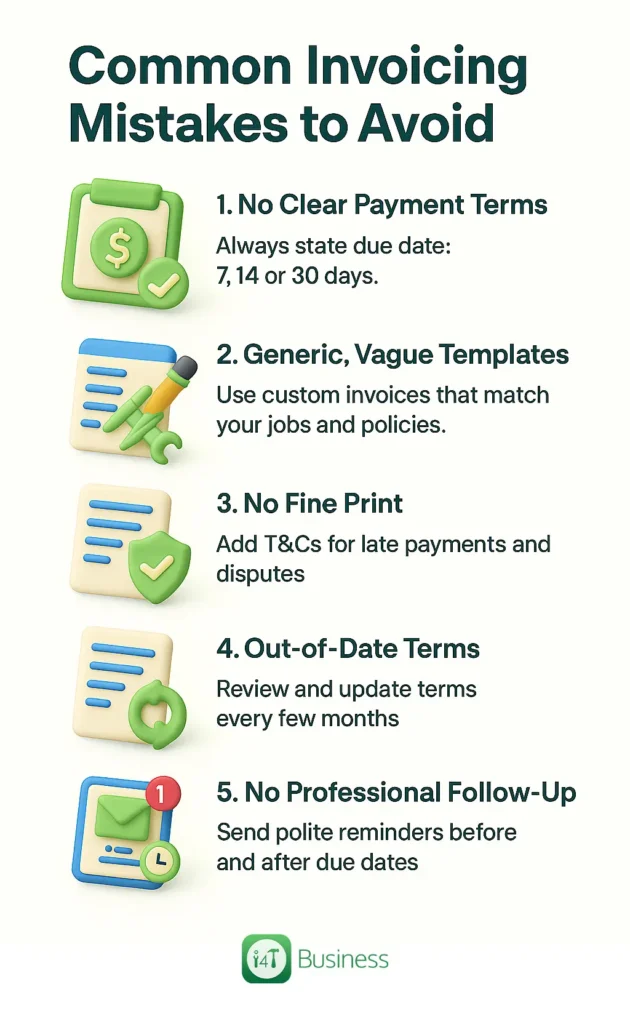

Common Invoicing Mistakes to Avoid

Even with the best intentions, a lot of Aussie tradies and small business owners make simple invoicing mistakes that end up costing them time, money, and reputation. These slip-ups can confuse clients, delay payments, or make your invoice terms and conditions unenforceable.

Knowing what not to do is just as important as knowing what to include.

Forgetting to Include Clear Payment Terms

If you don’t specify when payment is due, your clients might assume they can pay whenever they like. Always include a clear timeframe, like 7, 14, or 30 days, in your invoice terms.

Using Generic or Vague Templates

A one-size-fits-all template might seem easy, but it rarely covers your specific services or legal requirements. Customise your invoices to reflect your business, scope of work, and policies.

Leaving Out the Fine Print

Many small businesses skip terms and conditions altogether. That’s risky, because without them, you have little legal backup if payments are delayed or disputes arise.

Not Updating Your Terms Regularly

Laws and business needs change. Review your invoice terms and conditions every few months to ensure they reflect your current processes, prices, and policies.

Forgetting to Follow Up Professionally

Waiting weeks before chasing overdue invoices hurts cash flow. Set automated reminders or polite follow-ups instead of letting payments drag on.

Keep Your Cash Flow Smooth and Your Clients Happy

Clear invoice terms and conditions aren’t just about legal protection; they’re about running a smarter, smoother business. When your invoices spell everything out upfront, you get paid faster, avoid disputes, and build stronger trust with every client.

So, take a few minutes to review your current terms. Tighten them up, make them clear, and let your invoices do the heavy lifting for you.

Ready to simplify invoicing and get paid on time, every time? Try i4T Business – Job Management Software that helps tradies send professional invoices and track payments with ease. Start your free trial today!

FAQs

Absolutely. Including a clear scope of work in your invoice terms helps prevent misunderstandings and ensures you’re only paid for the services agreed upon.

Most Australian businesses use payment terms between 7 and 30 days, depending on job size, industry, and client agreements.

Yes, as long as the late payment fee is clearly stated in your invoice terms and conditions and is reasonable. Always communicate it before starting the job.

Yes. Businesses can request deposits or staged payments if they’re clearly written in the invoice terms and conditions and agreed upon before work begins.

Most Australian contracts hold retention for 30 to 90 days after project completion, but it varies by industry. Always include exact timeframes in your terms.

Most tradies offer a 12-month workmanship warranty, though it can vary by trade and state. Always include warranty details in your invoice terms and conditions.

Yes. A liability disclaimer protects your business from being held responsible for issues outside your control and adds professionalism to your invoices.

Yes, provided it’s stated in your invoice terms and conditions. A reasonable cancellation fee helps cover your time, travel, or materials already purchased.

Yes. Including basic privacy terms reassures clients that their personal data is handled securely and in compliance with Australian Privacy Principles (APPs).

Yes. It ensures any disputes are handled under your chosen state’s laws, saving time, confusion, and legal costs if issues arise.

Hot off the press!

With our cutting-edge technology and in-depth knowledge of how the Field Service Management sector operates, the i4TGlobal Team loves to share industry insights to help streamline your business processes and generate new leads. We are driven by innovation and are passionate about delivering solutions that are transparent, compliant, efficient and safe for all stakeholders and across all touch points.