Late payments from customers can be a real headache for any business. It can mess with your cash flow, slow down your business growth, and stress you out. Let’s be honest; managing invoices manually can be quite challenging as it takes more time and much effort and is prone to human errors.

That’s where automated invoice management comes into play. It can take your stress away, help you get paid faster, and avoid those cash flow headaches.

In this blog article, we will show you how automating invoice management can help you minimise delays in preparing invoices, get payments from clients quickly, and improve your overall operations

Understanding automated invoicing

You know how stressful it can be if you’re still manually handling your invoices. Apart from preparing your invoices, you should chase down payments, fix mistakes, and keep track of the whole invoicing process. It’s a lot to handle manually.

But there’s a smarter way to do it. Automated invoicing takes all that hassle off your plate, making your life a whole lot easier and your business run smoother. Before moving any further, let’s find out what automated invoicing is. Think of it as a system that handles your invoicing for you.

Automated invoicing creates, sends, and even follows up on invoices, all without much effort from your side.

Once you set up automated invoicing, it works in the background, making sure invoices go out on time and payments come in faster.

How it’s different from manual invoicing

Manual invoicing might seem fine when you’re just starting, but as your business grows, it can quickly become inefficient. Here’s how automated invoicing makes a difference:

- Less work: Manual invoicing involves multiple steps like creating the invoice, emailing it, and following up for payment. Automation handles all of that for you.

- More accuracy: Manual work has more room for mistakes. Automation ensures that everything is consistent and accurate.

- Faster payments: Automated reminders encourage customers to pay sooner, so you spend less time chasing payments.

- Easy tracking: Forget digging through spreadsheets. Automation gives you a clear view of what’s been paid and what’s still due.

Key components of an automated invoicing system

Not all automated invoicing systems are the same. Here are some of the must-have features in an automated invoicing system that will make your life much easier:

- Automatic invoice creation: Generates invoices with your business details, service descriptions, and payment terms, all ready to go.

- Payment reminders: Sends friendly reminders to customers when payments are due or overdue.

- Easy online payments: Allows customers to pay through the invoice using credit cards or other online payment options.

- Expense tracking: Keeps track of your income and expenses in one place.

- Mobile access: Manage everything on the go from your mobile device, which is perfect when you’re out in the field.

What are the benefits of automating the invoice management process

Automating your invoice management process can bring various benefits to your business. Let’s break down some of these key benefits so that you can have a clear idea.

Eliminating manual errors

Mistakes are common when you’re doing things manually. You might add wrong amounts, miss important details, or even send the same invoice twice. Automating the invoice process will take care of all that and ensure that you send out accurate invoices to your clients.

Accelerating payment processing

When you automate invoice management, you can send out invoices without any delay. You can also add automatic reminders to get back your payments sooner.

Enhancing cash flow management

It can make a huge difference if you know when your money is coming in. Automated invoicing helps you stay on top of payments and plan your finances better so you’re not caught off guard.

Reducing administrative work

Are you tired of spending hours doing your invoices? Automation does heavy lifting, giving you back time to focus on more important stuff like growing your business or spending time with your customers.

Improving customer experience

Customers appreciate clear, professional invoices with easy payment options. Automated systems will improve customer experience and make payments simpler and hassle-free. Therefore, your clients will be happier, and it will help you get paid on time.

Ensuring compliance and security

Keeping track of tax rules and protecting customer information can be stressful. Automation helps you stay compliant and keeps your data secure with built-in protection so you can stop worrying.

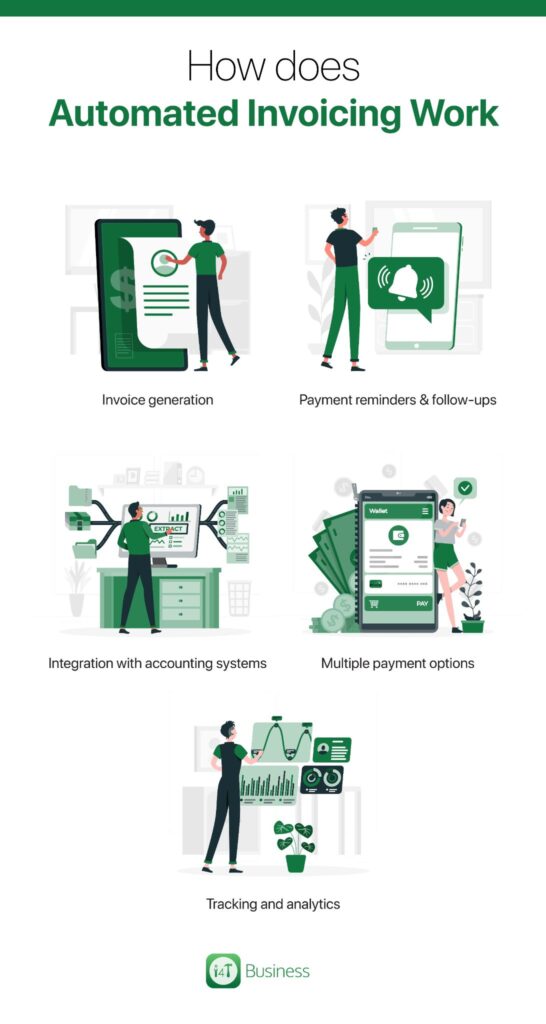

How does automated invoicing work

We have been talking about automated invoicing from the beginning of this article. Now, you might be wondering how it works. Let’s walk through and see how it all works.

Invoice generation

You don’t have to manually type out each invoice. Automated invoicing systems generate professional invoices based on the details you’ve set, such as service descriptions, costs, and due dates. Then, send them directly to your clients, which is fast and accurate and saves you hours of administrative work.

Payment reminders & follow-ups

Are you tired of chasing down payments? Automated invoicing systems send friendly reminders to clients when a payment is due or overdue. Regular follow-ups like this will help avoid late payments and keep your cash flow steady.

Integration with accounting systems

Automated invoicing can connect with your accounting software to link everything in real time. Therefore, you don’t have to deal with double data entry or messy records anymore. Your income, expenses, and taxes can be calculated, organised, and kept up to date without much effort. Therefore, it’s much easier to track your finances.

Multiple payment options

Offering multiple ways to pay, like credit cards, online transfers, and mobile payments, will make it easier for your clients to settle the invoices quickly. Automated invoice systems integrate with payment gateways to give your customers a seamless experience and help you get paid faster.

Tracking and analytics

Automated invoicing gives you a clear view of the invoices that are paid, pending, and overdue at a glance. Plus, it provides insights into payment trends, helping you spot patterns and improving your cash flow management.

What are the best practices for implementing automated invoicing system

Even if you are using an automated invoicing system, you should follow certain best practices to get the most out of it. You should implement it the right way at the first time itself. Here are some of the best practices that you can follow to implement an automated invoicing system.

Choosing the right invoicing software

Not all invoicing software is created equal. Go for a software solution that fits the needs of your business. Make sure it has critical features like automatic invoice generation, payment reminders, multiple payment options, and integrates with your accounting software. Your field team will always be on the move; therefore, make sure it’s mobile-friendly, too!

Customising invoices for your business

Your invoices should feel like part of your brand. Add your logo, business name, and contact details to give them a professional touch. Don’t forget to include clear descriptions of services, due dates, and payment options to avoid any confusion.

Setting clear payment terms

Make sure that your payment terms are crystal clear right on the invoice. Specify when payment is due, whether it’s 7 days, 14 days, or 30 days. Mention any late fees upfront to encourage clients to pay early.

Automating follow-ups & late payment penalties

Set up automatic reminders to nudge clients as the due date approaches. You don’t have to follow up manually on overdue payments. If payments are still late, your system can send another reminder with a note about late fees. This keeps everything polite but firm and improves your chances of getting paid faster.

Integrating with accounting & CRM systems

Sync your invoicing software with your accounting and CRM systems for a seamless workflow. This integration saves you from entering the same information twice, reduces errors, and gives you a full view of your client interactions and finances in one place. It’s a great way to improve your efficiency and make smarter business decisions.

What are the common challenges, and how to overcome them

Switching to automated invoicing is a smart move, but like anything new, it comes with its own set of challenges.

You should have a brief idea about these challenges and be ready to tackle them. So, let’s take a quick look at some of these challenges and learn how to overcome them without breaking a sweat.

Client resistance to digital invoicing

Some clients might be stuck in their ways and prefer old-school paper invoices. The best way to handle this is to educate them on the benefits like faster delivery, easy payment options, and less paperwork. You can even offer a walkthrough of the process to show them how simple and secure it is. Once they see how much easier it makes their life, they’ll be on board in no time.

Managing subscription-based invoices

Managing recurring invoices can get tricky if you offer services on a subscription basis. But don’t worry; automated invoicing systems are built for this! You can simply set up the recurring billing once, and the system will take care of it for you. It will keep on sending invoices at the right time until they are cancelled. Just keep in mind that you should review it regularly to avoid any billing errors.

Handling payment delays

Late payments can mess up your cash flow. To reduce delays, consider offering early payment discounts as an incentive. For clients who are consistently late, implement a clear late fee policy. Automated systems can send reminders and apply penalties automatically, helping you stay on top of payments without having uncomfortable conversations with clients.

Ensuring data security

With invoicing going digital, keeping client and financial data secure is critical. Choose a platform with strong security measures like encryption, two-factor authentication, and regular backups. This will protect your data from cyber threats and give both you and your clients peace of mind.

Conclusion

Automated invoicing systems will make your life easier by cutting down on manual work, minimising human errors, and helping you to get paid faster. Further, you can spend less time chasing invoices and more time growing your business with a better invoicing system.

Are you looking for software with all the essential features to do your invoices and manage your field service business smoothly? Then, check out i4T Business’ invoice management tool. It’s got automated invoicing and all other essential features, including job scheduling, real time tracking, real time communication, and many more, so you can run your business efficiently and keep a steady cash flow. Try our free trial today and see how our software can help you take your invoicing function to the next level.

FAQs

Yes, it’s perfect for small businesses looking to reduce administration work, improve cash flow, and scale operations efficiently.

.

Yes, most systems let you add your logo, payment terms, and service details to keep invoices consistent with your business branding.

Automated invoicing provides real-time status updates, helping you track paid, pending, and overdue invoices at a glance.

Absolutely! It cuts down on employee time, which you will have to allocate to preparing the invoices, following them up, and correcting errors.

Yes, automated systems organise and store invoices, making tax reporting easier and reducing errors in financial records.

Hot off the press!

Field Service Management sector operates, the i4TGlobal Team loves to share industry insights to help streamline your business processes and generate new leads. We are driven by innovation and are passionate about delivering solutions that are transparent, compliant, efficient and safe for all stakeholders and across all touch points.