Invoicing might not be the most exciting part of running a business, but it’s one of the most critical. Accurate and efficient invoicing keeps your cash flow steady and your customers happy, which is a win-win for any business. But with technology reshaping the way we work, is it time to trade in those trusty invoice templates for a more automated approach?

Don’t worry, in this article, we are going to clarify it for you. We’ll dive into the pros and cons of both invoice templates and automated invoicing systems so that you can identify the best match for you.

Further, we’ll explore how evolving business needs and the latest technology trends are influencing invoicing practices in 2025.

Invoice templates vs. automated invoicing: The basics explained

When managing the finances and cash flow of your business, it’s important to understand the tools that you can use. When it comes to preparing an invoice, invoice templates, and automated invoicing systems are two popular tools that you can use.

So, what do these tools do? When should you use them? Understanding these basics can help you pick what works best for you. Let’s dive in and break it down!

What are invoice templates?

These are simple and pre-designed formats that help you to create invoices manually. Think of them as an easy starting point where you just have to fill in the blanks with your client and job details.

Then, you are ready to send the invoice. These templates come in various formats, such as Word, Excel, or downloadable PDFs, making them easy to customise for your needs.

So when can you use them?

Invoice templates can be a simple and cost-effective solution if you’re a one-person team or a small field service business with just a handful of clients.

However, as your business expands and the invoicing process gets more complex, you might find yourself looking for a more automated option.

Invoice templates are a great starting point, but they may not keep up with the hustle and growth of a busy field service busines

What are automated invoicing tools?

This is like having a helping hand for your billing process. It creates and sends invoices for you, based on rules you set up. Instead of manually entering details every time, the software handles everything for you quickly and accurately. Therefore, these tools are a great way to save time and avoid the usual headaches of invoicing.

Most automated invoicing solutions are packed with helpful features like auto invoice scheduling, recurring billing for repeat customers, and integration with payment systems for easy transactions.

Further, automated invoicing solutions will track unpaid invoices to minimise late payments and keep a healthy cash flow. These features are especially handy for field service businesses that handle multiple clients and projects.

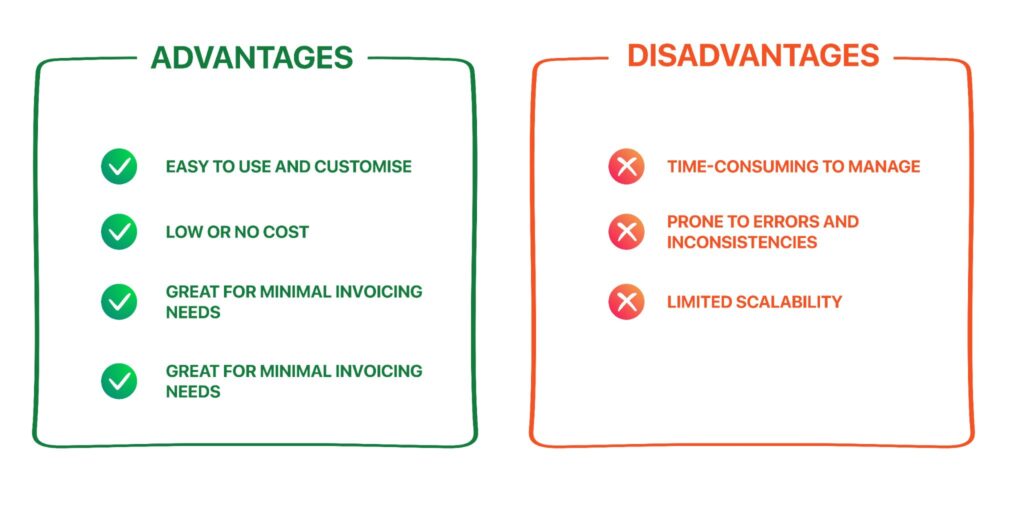

What are the pros and cons of invoice templates?

While invoice templates are a popular choice for many small businesses, they come with their own set of pros and cons. Let’s take a look at some of them in brief.

Advantages

- Easy to use and customise: Invoice templates are pretty straightforward. You can easily add your business details, logo, and any specific fields you need. Therefore, you can make a professional invoice without any hassle.

- Low or no cost: Most templates are free or come with basic tools like Word or Excel, so you don’t have to spend extra. For a small business or startup, this can be a budget-friendly solution.

- Great for minimal invoicing needs: If you only deal with a handful of clients or send invoices occasionally, templates can get the job done without overwhelming you.

Disadvantages

- Time-consuming to manage: Filling out each invoice manually, especially for multiple clients, will take time. It’s manageable for a few invoices but quickly becomes stressful as your workload grows.

- Prone to errors and inconsistencies: With manual entry, there’s always a risk of errors like typos, missing details, or forgetting to update fields. This can confuse your clients and will delay their payments.

- Limited scalability: As your business grows and you handle more clients and invoices, templates can become inefficient. Managing them manually might slow you down, making it harder to keep up with the demands of a growing field service business.

What are the pros and cons of automated invoicing

Preparing invoices manually will consume more of your time, especially when your business starts to grow. That’s where automated invoicing tools will become handy. They have features to handle your billing in a smarter and faster way.

But like any tool, it has its ups and downs. Let’s explore these key benefits and potential challenges that you would come up with automated invoicing tools.

Advantages

- Saves time with auto-generated invoices: They take care of repetitive tasks like creating and sending invoices. Therefore, you can free up your time to focus on running your business instead of dealing with paperwork.

- Reduces errors with built-in calculations: You don’t have to double-check your calculations or worry about typos anymore. Automated systems will handle them for you, improving the accuracy of your invoices.

- Provides real-time tracking and analytics: These systems let you know the status of every invoice, whether it’s sent, paid, or overdue. Plus, they give you insights into your cash flow and client payment trends at a glance.

- Scales easily for growing businesses: As your business grows and you handle more clients, automated invoicing will handle that for you. You won’t need to spend extra time or resources managing a larger volume of invoices.

- Integrates with payment gateways for faster payments: Automated invoicing tools often connect directly to payment systems like PayPal or Stripe. This makes it easier for clients to pay you quickly and securely.

Disadvantages

- Higher upfront cost or subscription fees: Unlike free templates, automated invoicing tools usually come with a price tag. You would have to pay an upfront fee or a monthly subscription, which might feel steep for smaller businesses.

- The learning curve for new users: Setting up and learning the software might take some time, especially if you’re not familiar with the technology. However, most platforms offer tutorials to help you get started.

- Dependence on software reliability and updates: Most automated tools rely on software and internet connectivity. Any glitches, downtime, or delayed updates could disrupt your invoicing process temporarily.

Key differences between invoice templates and automated invoicing

Picking between invoice templates and automated invoicing can feel like a big decision, but it comes down to what your business needs. Let’s break it down in simple terms to help you figure out which option fits your workflow best.

Ease of Use

- Invoice templates: Templates are straightforward, and you have to manually fill in details like client information, services offered, and prices. You should do a bit of work, but manageable if you only have a few invoices.

- Automated invoicing: Automation does the job for you. Once set up, it creates and sends invoices automatically, schedules recurring ones, and even sends reminders. It’s a time-saver, especially when you’re handling multiple jobs.

Scalability

- Invoice templates: They work fine when your business is small, but as you get more clients, managing all those templates manually can get messy and slow.

- Automated invoicing: Perfect for growing businesses as automation handles as many invoices as you need without the extra effort. Whether you’re managing a few or hundreds of invoices, it will keep up with your pace.

Accuracy

- Invoice templates: Entering data manually always comes with a risk of mistakes—like typos, wrong amounts, and calculations, or missing vital data. These can lead to late payments or awkward moments with clients.

- Automated invoicing: With automation, the system handles calculations and ensures every piece of data is accurate. Therefore, you will have fewer mistakes, and your invoices will look professional all the time.

Cost

- Invoice templates: Templates are budget friendly as they are usually free or included with programs like Word or Excel. But the time you spend creating and managing them can go beyond these benefits.

- Automated invoicing: Automated systems cost more upfront, often with a monthly subscription. However, the time you save and the efficiency it brings can make it a worthwhile investment for busy businesses.

Which one is right for your business?

Invoice templates are a great starting point, but they may not keep up with the hustle and growth of a busy field service busines

Let’s break it down so you can choose what fits your field service business best.

When to choose invoice templates

- For freelancers or small businesses with few clients: Templates are an easy and affordable way to manage your invoices if you’re running a small operation or just starting. They’re easy to set up, and the manual effort won’t feel overwhelming with fewer clients.

- For low transaction volumes: If your business only handles a handful of invoices each month, templates can handle the job without using expensive tools. They’re ideal for businesses with straightforward invoicing needs, like one-off jobs or occasional repeat customers.

- When budget is tight: Templates don’t cost a thing if you’re using basic tools like Word or Excel. For businesses trying to save on costs, this is a practical solution. Just remember, as your client base grows, managing such templates can be time-consuming.

If you are looking for a more sophisticated invoice template tool, make sure to check out i4T Business Invoice Generator. It’s free and has more features than an average invoice generator.

When to choose automated invoicing

For companies managing high volumes of clients or invoices: If your field service business is buzzing with multiple jobs a day, automated invoicing is a lifesaver. It keeps up with the demand, creating and sending invoices without slowing you down.

- For integration with accounting software: Automated invoicing tools often sync with accounting systems like Xero, MYOB or QuickBooks. Therefore, all your financial data is in one place, which makes bookkeeping and tax preparation much easier.

- For real-time tracking and reminders: Automated systems track invoices for you, showing what’s paid, pending, or overdue. They can even send gentle reminders to clients, so you don’t have to.

- For businesses prioritising timesaving and scalability: If you’re looking to grow your business or just want to save time, automation is the way to go. It streamlines your invoicing process, reduces errors, and adapts as your client base expands.

The future of invoicing in 2025

With time invoicing is getting smarter, faster, and easier. By 2025, we’re going to see some exciting changes that can make life so much simpler for businesses like yours. Let’s look at the trends shaping the future of invoicing and how they can help you stay on top of your billing game.

AI and automation trends

- Smarter invoicing with AI: Imagine software that knows when to send invoices or reminders without you having to think about it. AI tools are making this possible by predicting the best times to follow up and keeping payments on track.

- Automatic payment reminders: You can forget about chasing clients because AI-powered systems can nudge them gently with reminders for upcoming or overdue payments. It saves you a ton of time and stress.

Mobile-friendly invoicing

- Invoicing anywhere, anytime: Mobile invoicing applications are becoming more important. Whether you’re on a job site, in your van, or grabbing a coffee, these applications help you to create and send invoices on the go. So you don’t have to wait until you’re back at the office.

- Instant updates: Mobile tools synchronise with your invoicing system in real time, so you can track payments from wherever you are.

Integration with digital payment systems

- Faster payments with one click: When progressing with modern technology, it is important to make it easy for your clients to pay their due charges. With integrations like PayPal, Stripe, or bank transfers, they can settle invoices instantly, which improves your cash flow.

- Handling global payments: If you’re working with clients in different countries, invoicing systems are stepping up to make international transactions smoother and stress-free.

Wrapping up

When it comes to invoicing, both invoice templates and automated invoicing have their strengths and weaknesses. Templates are simple, cost-effective, and work well for small businesses or freelancers that have fewer clients.

As your business grows and things get busier, automated invoicing becomes the smarter choice as it saves time, reduces errors, and helps you stay organised.

The right choice really depends on your business size, how complex your invoicing needs are, and where you’re headed in terms of growth. If you’re just starting out or managing a handful of clients, templates might do the job.

But if you’re handling multiple jobs, managing recurring invoices, or need better cash flow tracking, automation is worth exploring.

Take a moment to evaluate what your business needs most. If efficiency and scalability are at the top of your list, tools like i4T Business can make invoicing effortless. With features like automated reminders, payment tracking, and seamless integration with payment systems, you can focus less on admin tasks and more on growing your field service business.

So, are you ready to see the difference automated invoicing can make? Reach out to our team today and try our free trial. Give it a try and experience how i4T Business could benefit your business in different ways. If you sign up with us, we can assure you that your future self will thank you!

FAQs

Most automated invoicing tools require an internet connection but offer offline drafts or limited features in some cases.

Automated systems use encryption and secure servers to protect sensitive data, making them safer than storing paper or manual invoices.

Yes, most systems let you add logos, brand details, and specific fields to match your business needs

Templates can include tax fields, but you must manually update rates and calculate totals for each invoice.

Yes, many automated invoicing systems sync with CRM platforms to streamline client management and billing.

Hot off the press!

Field Service Management sector operates, the i4TGlobal Team loves to share industry insights to help streamline your business processes and generate new leads. We are driven by innovation and are passionate about delivering solutions that are transparent, compliant, efficient and safe for all stakeholders and across all touch points.